Born in São Paulo, Brazil, Saverin has carved a niche for himself as one of the most prominent figures in the tech and investment world. With a net worth that has soared into the billions, his journey from a Harvard dorm room to becoming a key player in the global tech ecosystem is nothing short of inspiring. As a co-founder of Facebook, Saverin played a pivotal role in shaping the social media giant’s early days, and his financial acumen has only grown stronger over the years. Today, his wealth is not just a reflection of his past successes but also his ability to spot lucrative opportunities in emerging markets. Saverin’s transformation into a billionaire investor is deeply rooted in his ability to diversify his portfolio beyond Facebook. After renouncing his U.S. citizenship in 2011 and relocating to Singapore, he strategically positioned himself in Asia's booming tech scene. His investments in startups like Grab, a ride-hailing giant, and other ventures have significantly contributed to his growing net worth. As of 2023, Eduardo Saverin’s net worth is estimated to be over $12 billion, a figure that continues to evolve as his ventures expand. This financial milestone not only highlights his business acumen but also underscores his knack for identifying trends that redefine industries. Understanding Eduardo Saverin's net worth is more than just tracking numbers—it’s about appreciating the journey and strategies behind his success. From his early days as a Harvard student to his current status as a global investor, Saverin’s story is one of resilience, innovation, and foresight. His ability to pivot from being a co-founder of one of the world’s largest social media platforms to becoming a key player in the Asian tech ecosystem showcases his adaptability and vision. This article delves into the intricacies of his financial achievements, personal life, and the factors that have contributed to his remarkable net worth.

Table of Contents

- Biography: The Man Behind the Name

- Personal Details and Bio Data

- What Shaped Eduardo Saverin's Early Life and Education?

- How Did Eduardo Saverin Contribute to Facebook’s Success?

- Eduardo Saverin Net Worth: A Detailed Breakdown

- What Drives Eduardo Saverin’s Investment Strategy?

- Why Did Eduardo Saverin Renounce His U.S. Citizenship?

- How Does Eduardo Saverin Contribute to Philanthropy?

- Frequently Asked Questions

Biography: The Man Behind the Name

Eduardo Saverin is a name synonymous with innovation, entrepreneurship, and strategic investments. Born on March 19, 1982, in São Paulo, Brazil, Saverin’s journey from a middle-class upbringing to becoming one of the wealthiest individuals in the world is a story of ambition and perseverance. As the co-founder of Facebook, he played a pivotal role in the platform’s early development, laying the groundwork for what would become a global phenomenon. Despite controversies and legal battles, Saverin’s legacy as a tech visionary and investor remains intact, with his net worth reflecting his continued success in the business world.

Personal Details and Bio Data

| Full Name | Eduardo Luiz Saverin |

|---|---|

| Date of Birth | March 19, 1982 |

| Place of Birth | São Paulo, Brazil |

| Nationality | Brazilian (Formerly American) |

| Education | Harvard University (Economics) |

| Profession | Entrepreneur, Investor |

| Net Worth | Over $12 billion (2023) |

| Notable Ventures | Facebook, Grab, various tech startups |

What Shaped Eduardo Saverin's Early Life and Education?

Eduardo Saverin’s early life was marked by a blend of privilege and challenges that shaped his entrepreneurial mindset. Born into a wealthy Jewish family in São Paulo, Brazil, Saverin enjoyed access to quality education and opportunities from a young age. His father, Roberto Saverin, was a successful businessman in the clothing and real estate industries, which likely influenced Eduardo’s interest in business and finance. However, the family’s comfortable lifestyle was not without its hurdles. In the late 1990s, during a period of economic instability in Brazil, the Saverins decided to relocate to Miami, Florida, seeking better prospects and a safer environment for their children.

Read also:Jessica Tarlov A Splash Of Style In Every Bikini Image

Education and Academic Achievements

Eduardo’s academic journey began in Miami, where he attended Gulliver Preparatory School. Known for its rigorous curriculum, the school provided Saverin with a strong foundation in economics and business. His exceptional performance earned him a place at Harvard University, where he pursued a degree in economics. At Harvard, Saverin distinguished himself as a top student, excelling in subjects like finance and entrepreneurship. His academic achievements were complemented by his role as the president of the Harvard Investment Association, where he honed his skills in financial management and investment strategies.

Early Ventures and Entrepreneurial Spirit

Even before Facebook, Saverin demonstrated a keen interest in entrepreneurship. During his time at Harvard, he launched a profitable online platform called Joboozle, which connected students with potential employers. This early venture showcased his ability to identify market needs and create solutions. Saverin’s entrepreneurial spirit, combined with his academic background, laid the foundation for his future success. It was this combination of skills and experiences that prepared him for the groundbreaking opportunity that awaited him in his senior year—co-founding Facebook.

How Did Eduardo Saverin Contribute to Facebook’s Success?

Eduardo Saverin’s role in Facebook’s early days was instrumental in transforming the platform from a college networking site into a global phenomenon. As one of the co-founders, Saverin provided the initial financial backing and strategic insights that helped Facebook gain traction. His contributions extended beyond funding; he played a crucial role in shaping the platform’s business model and monetization strategies. Saverin’s expertise in finance and economics proved invaluable in navigating the challenges of scaling a startup, ensuring that Facebook had the resources it needed to grow.

The Founding Story and Saverin’s Role

Facebook’s origins trace back to a Harvard dorm room in 2004, where Eduardo Saverin, alongside Mark Zuckerberg and a few others, conceptualized the idea of a social networking platform for college students. Saverin’s initial investment of $15,000 provided the seed capital necessary to launch the platform. He also served as the company’s first CFO, managing finances and overseeing advertising strategies. His efforts were critical in securing early advertisers, which helped Facebook generate revenue and establish a sustainable business model. Saverin’s involvement in these early stages laid the groundwork for Facebook’s rapid expansion.

The Legal Battle and Its Aftermath

Despite his significant contributions, Eduardo Saverin’s journey with Facebook was not without challenges. A legal dispute arose between Saverin and Zuckerberg over Saverin’s ownership stake in the company. The disagreement culminated in a lawsuit, which was eventually settled out of court. As part of the settlement, Saverin’s stake in Facebook was reduced, but he retained a substantial share that would later contribute to his billionaire status. This period marked a turning point in Saverin’s career, prompting him to focus on new ventures and investments outside of Facebook.

Eduardo Saverin Net Worth: A Detailed Breakdown

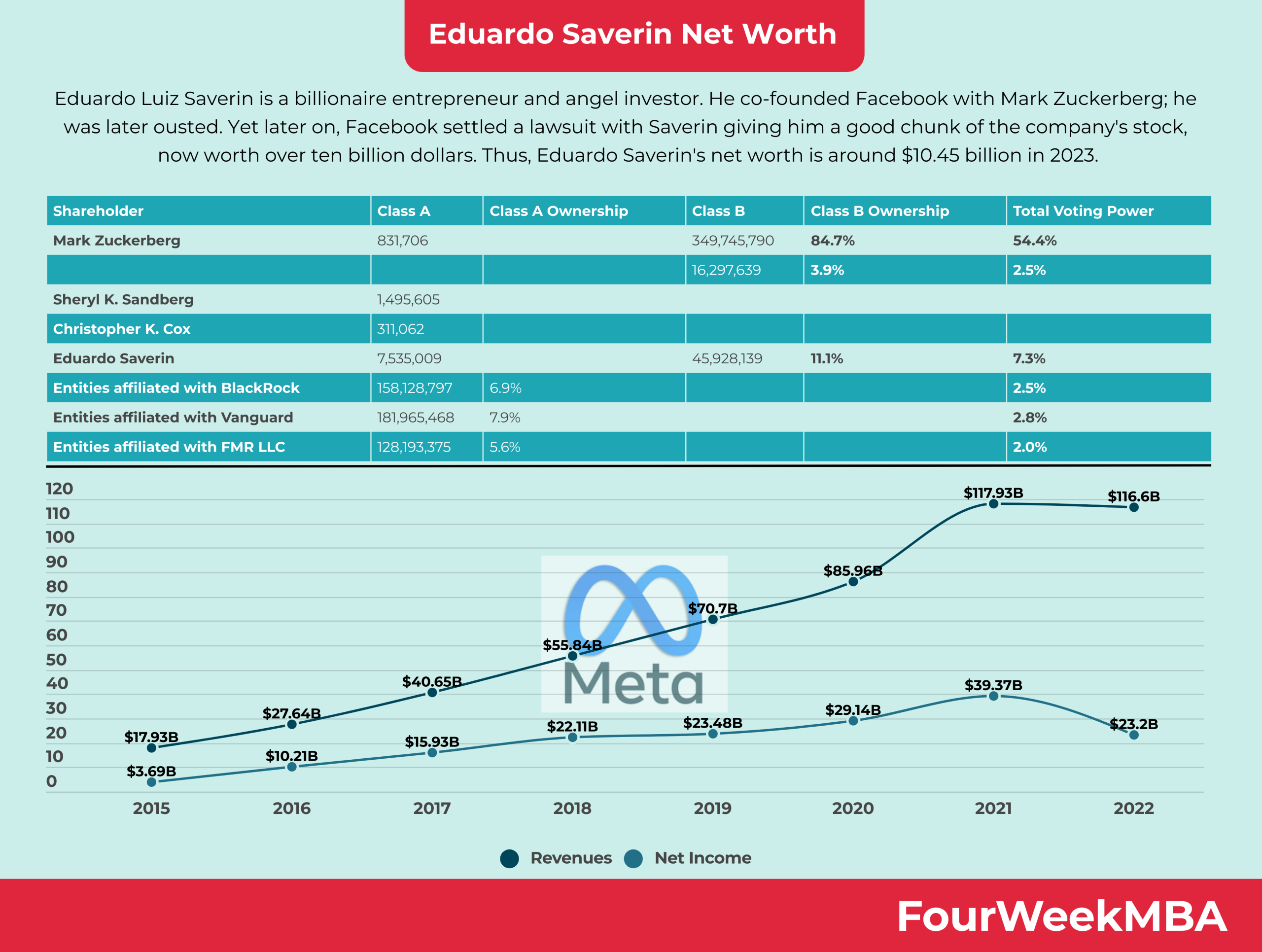

Eduardo Saverin’s net worth is a reflection of his strategic investments and entrepreneurial endeavors. While his stake in Facebook remains a significant contributor to his wealth, his diversified portfolio has played an equally important role in his financial success. As of 2023, Saverin’s net worth is estimated to exceed $12 billion, with his assets spread across various industries, including technology, finance, and real estate. This section delves into the key components that have shaped his impressive net worth.

Read also:Unveiling The True Identity Who Is Naturally Bionka

Facebook: The Foundation of His Wealth

Saverin’s initial investment of $15,000 in Facebook proved to be one of the most lucrative decisions of his life. Although his ownership stake was diluted over time due to subsequent funding rounds and legal settlements, his remaining shares in the company are worth billions. Facebook’s meteoric rise from a college networking site to a global tech giant has been a cornerstone of Saverin’s financial success. Even after distancing himself from the company’s day-to-day operations, his shares continue to generate substantial returns, contributing significantly to his net worth.

Investments in Asian Tech Startups

After relocating to Singapore, Saverin shifted his focus to investing in emerging markets, particularly in Asia. One of his most notable investments is in Grab, a Singapore-based ride-hailing and delivery service that has become a regional leader. Saverin’s early backing of Grab has paid off handsomely, with the company’s valuation skyrocketing in recent years. In addition to Grab, he has invested in other tech startups across Southeast Asia, leveraging his expertise to identify high-potential ventures. These investments have not only diversified his portfolio but also solidified his reputation as a savvy investor.

What Drives Eduardo Saverin’s Investment Strategy?

Eduardo Saverin’s investment strategy is characterized by a meticulous approach to identifying and nurturing high-growth opportunities. Unlike traditional investors who may focus solely on short-term gains, Saverin prioritizes long-term value creation. His ability to spot trends and anticipate market shifts has been a key factor in his success. By concentrating on emerging markets and disruptive technologies, Saverin has positioned himself at the forefront of innovation, ensuring that his investments yield substantial returns over time.

Focus on Emerging Markets

One of the defining aspects of Saverin’s investment philosophy is his emphasis on emerging markets, particularly in Asia. Recognizing the region’s rapid economic growth and increasing digital adoption, he has strategically invested in companies that cater to these trends. His decision to relocate to Singapore further underscores his commitment to tapping into Asia’s burgeoning tech ecosystem. By aligning himself with local entrepreneurs and startups, Saverin has been able to capitalize on opportunities that others might overlook.

Risk Management and Portfolio Diversification

Saverin’s approach to risk management is another critical element of his investment strategy. Rather than placing all his bets on a single venture, he diversifies his portfolio across multiple industries and geographies. This approach not only mitigates risks but also ensures a steady stream of returns. Additionally, Saverin’s hands-on involvement in the companies he invests in allows him to provide valuable guidance and support, further enhancing their chances of success. His ability to balance risk and reward has been instrumental in building and maintaining his impressive net worth.

Why Did Eduardo Saverin Renounce His U.S. Citizenship?

Eduardo Saverin’s decision to renounce his U.S. citizenship in 2011 sparked widespread debate and controversy. While the move was officially attributed to personal and business reasons, it was widely speculated that tax considerations played a significant role. By relinquishing his American citizenship and becoming a permanent resident of Singapore, Saverin positioned himself to benefit from the city-state’s favorable tax policies. This strategic decision has allowed him to maximize his wealth while continuing to invest in high-growth opportunities across Asia.

Tax Implications and Public Reaction

Singapore’s low tax rates and absence of capital gains tax made it an attractive destination for Saverin, particularly as Facebook prepared for its highly anticipated IPO. Critics, however, accused him of abandoning his American roots to avoid paying taxes on his Facebook shares. The backlash was swift, with some lawmakers proposing legislation to impose an "exit tax" on wealthy individuals who renounce their citizenship. Despite the criticism, Saverin has maintained that his decision was driven by a desire to focus on opportunities in Asia, rather than tax avoidance.

Impact on His Business Ventures

Saverin’s relocation to Singapore has had a profound impact on his business ventures. By immersing himself in the region’s tech ecosystem, he has been able to forge valuable connections and identify promising startups. His status as a Singapore resident has