Exchange rates play a crucial role in the global economy, and understanding how they work is essential for anyone involved in international trade or travel. In Ethiopia, commercial banks are the primary institutions responsible for setting and managing exchange rates. These rates determine the value of the Ethiopian Birr (ETB) against foreign currencies like the US Dollar (USD), Euro (EUR), and others. For businesses, travelers, and investors, staying informed about commercial bank exchange rates in Ethiopia is vital for making sound financial decisions.

Ethiopia's economy has been growing steadily, and its financial sector is evolving to meet the demands of a globalized world. The country's central bank, the National Bank of Ethiopia (NBE), regulates the exchange rate system, but commercial banks play a key role in implementing these policies. Whether you're a local entrepreneur importing goods or an international traveler exchanging currency, the rates offered by commercial banks directly impact your finances.

This article will provide a comprehensive overview of commercial bank exchange rates in Ethiopia, covering everything from how these rates are determined to their implications for individuals and businesses. By the end of this guide, you'll have a clear understanding of how to navigate Ethiopia's currency exchange landscape and make informed decisions.

Read also:Unpacking Shane Libel The Untold Story Behind The Controversial Figure

Table of Contents

Introduction to Exchange Rates

Exchange rates represent the value of one currency in terms of another. For example, if the exchange rate for the Ethiopian Birr (ETB) to the US Dollar (USD) is 55 ETB to 1 USD, it means you need 55 Birr to buy one US Dollar. These rates fluctuate daily due to various economic factors and are influenced by supply and demand in the foreign exchange market.

In Ethiopia, the National Bank of Ethiopia (NBE) sets the official exchange rate, but commercial banks have some flexibility in offering rates to their customers. This flexibility allows banks to compete for clients by providing competitive rates for currency exchange services.

Understanding exchange rates is essential for anyone involved in international transactions. Whether you're sending money abroad, importing goods, or traveling, the exchange rate directly affects the cost of your transaction. For businesses, favorable exchange rates can reduce costs, while unfavorable rates can increase expenses.

Commercial Banks in Ethiopia

Ethiopia has a growing network of commercial banks that play a vital role in the country's financial system. These banks provide a wide range of services, including currency exchange, loans, and savings accounts. Some of the leading commercial banks in Ethiopia include:

- Commercial Bank of Ethiopia (CBE): The largest bank in the country, offering competitive exchange rates and a wide range of financial services.

- Dashen Bank: Known for its innovative banking solutions and strong presence in urban and rural areas.

- Awash Bank: A leading private bank with a focus on customer service and competitive exchange rates.

- Berhan International Bank: Offers specialized services for businesses and individuals, including currency exchange.

Data Table: Leading Commercial Banks in Ethiopia

| Bank Name | Year Established | Headquarters | Key Services |

|---|---|---|---|

| Commercial Bank of Ethiopia (CBE) | 1942 | Addis Ababa | Currency Exchange, Loans, Savings Accounts |

| Dashen Bank | 1995 | Addis Ababa | Mobile Banking, Currency Exchange |

| Awash Bank | 1994 | Addis Ababa | Business Loans, Currency Exchange |

| Berhan International Bank | 1996 | Addis Ababa | Trade Finance, Currency Exchange |

How Exchange Rates Are Determined

The exchange rate system in Ethiopia is managed by the National Bank of Ethiopia (NBE), which sets the official rate for the Ethiopian Birr. However, commercial banks have the authority to adjust their rates within a specified range. This flexibility allows banks to offer competitive rates to attract customers.

Exchange rates are influenced by several factors, including:

Read also:Unveiling The World Of 9xmovies Hub A Comprehensive Guide To Legal Streaming Options

- Supply and Demand: If the demand for foreign currency exceeds supply, the value of the Birr may decrease.

- Inflation Rates: Higher inflation in Ethiopia compared to other countries can lead to a weaker Birr.

- Interest Rates: Changes in interest rates set by the central bank can impact exchange rates.

- Political and Economic Stability: Political unrest or economic uncertainty can negatively affect the Birr's value.

Factors Influencing Exchange Rates

Several key factors influence exchange rates in Ethiopia:

- Trade Balance: A trade deficit, where imports exceed exports, can weaken the Birr.

- Foreign Investment: Increased foreign investment can strengthen the Birr by increasing demand for the currency.

- Government Policies: Policies that encourage exports or attract foreign capital can positively impact exchange rates.

Current Exchange Rates in Ethiopia

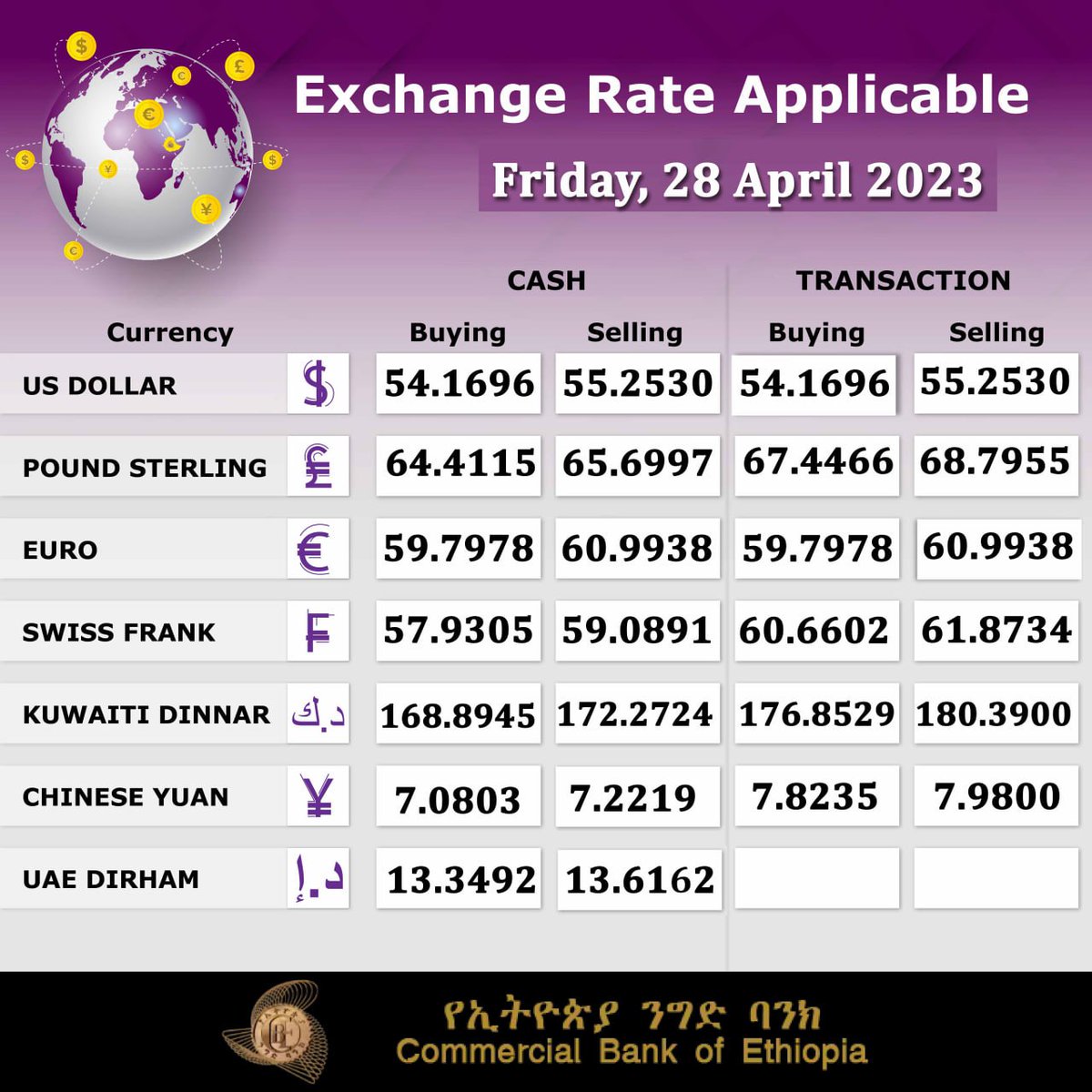

As of the latest data, the exchange rate for the Ethiopian Birr (ETB) to the US Dollar (USD) is approximately 55 ETB to 1 USD. However, these rates can vary slightly between commercial banks due to their pricing strategies. It's important to check with multiple banks to find the most favorable rate.

For example, the Commercial Bank of Ethiopia (CBE) may offer a slightly different rate compared to Dashen Bank. Additionally, exchange rates for other currencies, such as the Euro (EUR) or British Pound (GBP), are also available through commercial banks.

Impact on Businesses

Exchange rates have a significant impact on businesses in Ethiopia, particularly those involved in international trade. For importers, a weaker Birr means higher costs for purchasing foreign goods. Conversely, a stronger Birr can reduce import costs and improve profitability.

Exporters, on the other hand, benefit from a weaker Birr as it makes their goods more competitive in the global market. However, they must also consider the cost of importing raw materials, which can be affected by exchange rate fluctuations.

Strategies for Businesses

- Hedge against currency risk by using financial instruments like forward contracts.

- Monitor exchange rate trends to make informed decisions about imports and exports.

- Work with reliable commercial banks to secure favorable rates.

Impact on Travelers

For travelers visiting Ethiopia, understanding exchange rates is essential for budgeting and managing expenses. A favorable exchange rate means travelers can get more Birr for their foreign currency, making their trip more affordable.

Conversely, a weaker Birr can make travel more expensive for international visitors. Travelers should compare exchange rates offered by different commercial banks to get the best deal. Additionally, it's advisable to exchange currency at banks rather than informal money changers to avoid scams.

Tips for Exchanging Currency

When exchanging currency in Ethiopia, consider the following tips:

- Compare rates from multiple commercial banks to find the best deal.

- Avoid informal money changers, as they may offer unfavorable rates or engage in fraudulent activities.

- Check for hidden fees or commissions when exchanging currency.

- Use official bank branches or ATMs to withdraw local currency.

Regulations and Policies

The National Bank of Ethiopia (NBE) plays a crucial role in regulating exchange rates and ensuring stability in the financial system. The NBE sets policies to control inflation, manage foreign exchange reserves, and promote economic growth.

Recent policies have focused on liberalizing the exchange rate system to make it more market-driven. This move aims to attract foreign investment and improve the competitiveness of Ethiopian exports in the global market.

Conclusion

Commercial bank exchange rates in Ethiopia are a critical component of the country's financial system. Understanding how these rates are determined and their impact on businesses and individuals is essential for making informed financial decisions. Whether you're an entrepreneur, traveler, or investor, staying informed about exchange rates can help you save money and achieve your goals.

We encourage you to share your thoughts and experiences with currency exchange in Ethiopia by leaving a comment below. Additionally, feel free to explore our other articles for more insights into Ethiopia's financial landscape.